Our Client

Onboarding Process

Join. Integrate. Elevate.

How Collective Finance Sets Up Your Finance Department for Long-Term Success

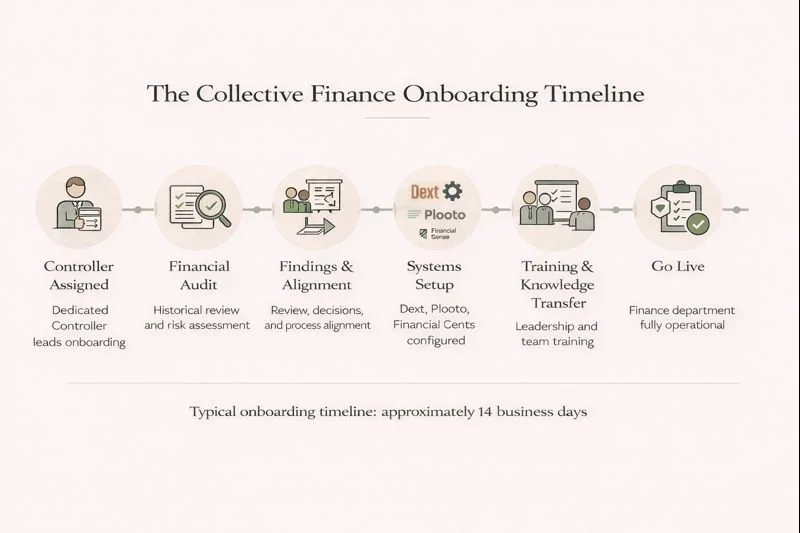

Strong financial operations start with a structured onboarding process.

Collective Finance onboarding is designed to bring clarity, identify risk early, and align your financial operations to a proven standard. Our goal is to ensure your finance department is set up correctly from day one, with no rushed transitions and no surprises later.

Onboarding is led by a dedicated Controller and typically completed within approximately 14 business days, depending on complexity and access timing.

Step 1 – Controller Assignment & Financial Audit

Your onboarding begins with the assignment of a dedicated Controller who leads the entire process.

The Controller performs:

A full audit of your historical financial records

Identification of inaccuracies, gaps, or inconsistencies

A review of current workflows, approvals, and systems

An assessment of compliance and operational risk

This step ensures we fully understand your financial landscape before any changes are made.

Step 2 – Findings Review & Alignment

Once the audit is complete, your Controller meets with leadership to review the findings.

This includes:

A clear summary of any historical inaccuracies

Options for addressing or leaving historical items unchanged

A review of current processes and recommended refinements

Alignment on how your operations will be brought in line with Collective Finance standards

Nothing is changed without discussion or approval. You remain in control of decisions.

Step 3 – Systems Setup & Standardization

After alignment, your Controller oversees the setup and configuration of your finance systems.

This may include:

Dext for receipt and invoice submission

Plooto for accounts payable approvals and payments

Financial Sense for task management and visibility

Other tools required for your engagement

Systems are configured to ensure proper controls, auditability, and continuity.

Step 4 – Team Training & Knowledge Transfer

Once systems are live:

Your assigned bookkeeper is trained on your file and workflows

Your leadership team is trained on where and how they interact with the finance department

Training typically covers:

How to submit receipts and invoices

How approvals work

Where leadership touches the process

What to expect at month-end

The focus is clarity and consistency, not added complexity.

Step 5 – Go Live & Ongoing Support

After onboarding is complete, your finance department goes live.

From there:

Financial operations run according to your engagement

Check-ins occur based on service level

Oversight and continuity are maintained by the Collective Finance team

Your finance function transitions smoothly into ongoing operations.

What to Expect During Onboarding

As part of onboarding, you receive a detailed reference guide outlining:

How your finance department operates

Key responsibilities and workflows

Where leadership and staff interact with systems

This documentation supports continuity and can be shared internally in the event of role changes or growth.

Documentation & Continuity

A rushed onboarding creates long-term problems.

Collective Finance onboarding ensures:

Risks are identified early

Expectations are clearly set

Systems and processes are aligned

Leadership understands their role without added burden

This is how stable finance departments are built.